Despite reporting a 24-percent gain in sales and revenues, a record near doubling of profit-per-share and an improved outlook for the rest of 2018, Caterpillar has announced that it will be raising machine prices in response to increased materials costs caused by new tariffs on steel and aluminum.

Cat surpassed Wall Street estimates and took a big step toward dispelling concerns over whether the new tariffs, enacted earlier this year by President Trump, would significantly impact operations. Those tariffs and another headwind – rising freight costs just as the company ramps up production – continue to present challenges that Caterpillar insists it can offset.

Cat surpassed Wall Street estimates and took a big step toward dispelling concerns over whether the new tariffs, enacted earlier this year by President Trump, would significantly impact operations. Those tariffs and another headwind – rising freight costs just as the company ramps up production – continue to present challenges that Caterpillar insists it can offset.

The metal tariffs are expected to have a $100 million to $200 million impact on material costs in the second half of the year. Caterpillar also expects supply chain challenges to continue to pressure freight costs.

However, the company intends to largely offset these headwinds through mid-year price increases and using what it calls the “Operating and Execution Model” to further drive operational excellence and structural cost discipline.

“Favorable price realization in the quarter also was enough to offset our increases in manufacturing costs, but we are seeing some increases in costs in the manufacturing space,” Joe Creed, interim chief financial officer, says.

“Most notably, steel costs are driving materials costs up, and then we’re also seeing elevated freight expense as we’re ramping up demand across our factories and supply base trying to keep up with our str0ng markets.”

The team’s “disciplined approach to cost control” is allowing the company to bring much of its profit to the bottom line, he notes.

A record-breaking 2Q

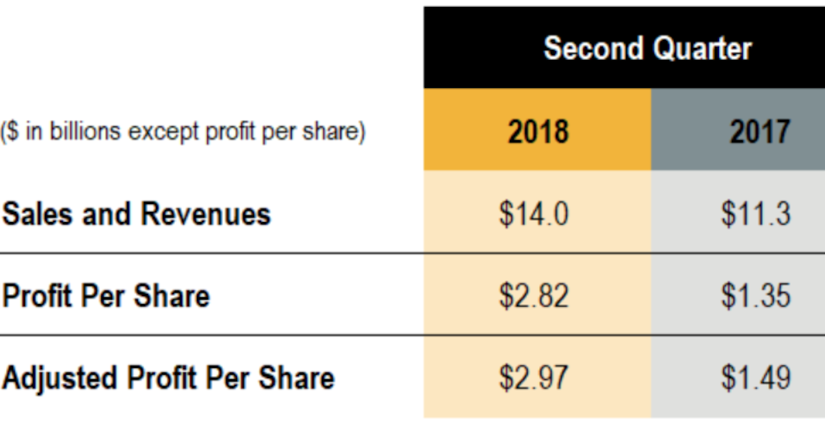

Second-quarter results include sales and revenues of $14 billion, compared with $11.3 billion for the same period in 2017. The company also reports a second-quarter record of $2.82 profit per share, up from $1.35 from 2Q 2017.

“Caterpillar delivered record second-quarter profit per share,” says Caterpillar CEO Jim Umpleby. “Our team is doing a great job executing our strategy for profitable growth, focusing on operational excellence, expanded offerings and services.”

Adjusted profit per share for the second quarter was $2.97, compared to $1.49 a year earlier.

That strong second-quarter profit led to $2.1 billion in operating cash flow – and to end the quarter with $8.7 billion of enterprise cash on hand.

The quarterly dividend rose by 10 percent or eight cents a share.

The company also announced the repurchase of $750 million of common stock, bringing year-to-date total to $1.25 billion of shares.

“That really showcases the strength of our balance sheet and how strong our results are right now,” Creed says.

Improved outlook for 2018

“Based on outstanding results in the first half of the year and continued strength in many of our end markets, Caterpillar is again raising our profit outlook for 2018, Umpleby says. “We remain focused on operational excellence, cost discipline and investing for long-term profitable growth.”

The company boosted its 2018 profit-per-share outlook to a range of $10.50 to $11.50.

Excluding restructuring costs of about $400 million, Cat expects adjusted profit per share to be in a range of $11 to $12. The adjusted profit per share outlook range had been $10.25 to $11.25, the company says.

Sales and revenues are staying strong as Cat reports continued vibrant demand across all three segments.

End markets continue to improve, order rates are healthy, and the backlog remained solid in the quarter. And for certain applications, particularly in oil and gas and mining, the company is seeing strong demand and taking orders for delivery well into 2019, Cat officials say.

Creed explains that construction industry sales across all regions, but primarily in North America and China, continue to strengthen from the first quarter.

In resource industries, there’s demand for new equipment showing up, largely due to commodity prices remaining strong.

And in energy and transportation, Creed says, sales are up across all four applications, but mostly in North American on-shore oil and gas.

from Equipment World https://ift.tt/2mVP0po

via Handy Rep Ai

Comments

Post a Comment